Insurance coverage defense is a kind of things which we frequently ignore until we really want it. It can be the safety net which can capture us when daily life throws us a curveball. Regardless of whether it's a sudden clinical crisis, a vehicle incident, or damage to your house, insurance safety ensures that you are not still left stranded. But, what exactly will it imply to get insurance safety? And how do you know if you're definitely protected? Let's dive into the entire world of insurance and discover its quite a few aspects to assist you understand why it's so essential.

How Flexible Insurance Solutions can Save You Time, Stress, and Money.

1st, Enable’s look at what coverage defense seriously is. It’s effectively a deal between you and an insurance provider that claims financial assistance during the function of the loss, hurt, or damage. In Trade for a month-to-month or yearly quality, the insurance company agrees to deal with certain hazards that you could possibly confront. This defense gives you peace of mind, realizing that If your worst occurs, you gained’t bear the complete fiscal burden on your own.

1st, Enable’s look at what coverage defense seriously is. It’s effectively a deal between you and an insurance provider that claims financial assistance during the function of the loss, hurt, or damage. In Trade for a month-to-month or yearly quality, the insurance company agrees to deal with certain hazards that you could possibly confront. This defense gives you peace of mind, realizing that If your worst occurs, you gained’t bear the complete fiscal burden on your own.Now, you might be thinking, "I’m wholesome, I push cautiously, and my residence is in fantastic condition. Do I really need insurance policies protection?" The reality is, we are able to never predict the future. Accidents occur, ailment strikes, and purely natural disasters take place without having warning. Insurance plan safety acts for a safeguard versus these unforeseen gatherings, encouraging you handle costs when things go Erroneous. It’s an investment as part of your long term effectively-staying.

Probably the most prevalent sorts of insurance security is overall health insurance coverage. It covers health care charges, from program checkups to crisis surgical procedures. With out health and fitness insurance policies, even a short medical center continue to be could depart you with crippling professional medical expenses. Wellbeing coverage enables you to access the treatment you require devoid of worrying about the money strain. It’s a lifeline in times of vulnerability.

Then, there’s vehicle insurance policies, which is an additional crucial form of safety. No matter whether you are driving a model-new car or an more mature design, accidents can occur at any time. With automobile insurance, you're covered inside the celebration of the crash, theft, or damage to your car or truck. Furthermore, should you be associated with a collision in which you're at fault, your coverage can help deal with the costs for the other bash’s car repairs and clinical expenses. In a method, car coverage is sort of a defend defending you from the implications of the unpredictable street.

Homeowners’ insurance coverage is yet another vital type of security, especially if you own your very own home. This coverage guards your house from many different challenges, together with hearth, theft, or purely natural disasters like floods or earthquakes. Devoid of it, you might face fiscal spoil if your own home ended up to be wrecked or severely harmed. Homeowners’ insurance plan not merely handles repairs, but additionally gives liability protection if another person is hurt on your residence. It really is a comprehensive basic safety net for your private home and all the things in it.

Lifestyle insurance plan is a person region That usually will get forgotten, but it surely’s equally as critical. Though it’s not a thing we wish to think about, daily life insurance coverage ensures that your family and friends are monetarily shielded if anything ended up to happen to you. It offers a payout to the beneficiaries, encouraging them cover funeral expenses, debts, or living expenditures. Existence insurance coverage is really a strategy for exhibiting your loved ones that you simply treatment, even Once you're gone.

A different method of coverage protection that’s becoming more and more popular is renters’ coverage. In the event you rent your house or condominium, your landlord’s coverage may address the constructing by itself, however it received’t protect your own belongings. Renters’ insurance plan is comparatively cost-effective and will guard your possessions in case of theft, fireplace, or other unforeseen gatherings. It’s a little investment that could help you save from major fiscal reduction.

Even though we’re on The subject of insurance plan, let’s not ignore disability insurance plan. It’s among the list of lesser-regarded types of protection, nonetheless it’s very crucial. Disability insurance policy gives profits alternative for those who turn into struggling to function resulting from disease or personal injury. It ensures that you don’t lose your livelihood if a thing unexpected transpires, permitting you to give attention to recovery with out stressing about your funds. For people who depend on their own paycheck to create finishes meet up with, incapacity coverage generally is a lifesaver.

Now, Allow’s talk about the importance of picking out the appropriate insurance policy provider. With a lot of possibilities to choose from, it might be mind-boggling to pick the proper a single for yourself. When picking out an insurance company, you need to be certain they provide the protection you will need at a selling price you can afford to pay for. It’s also crucial that you think about their standing, customer service, and the ease of submitting statements. In spite of everything, you desire an insurance provider that can have your back again when you need to have it most.

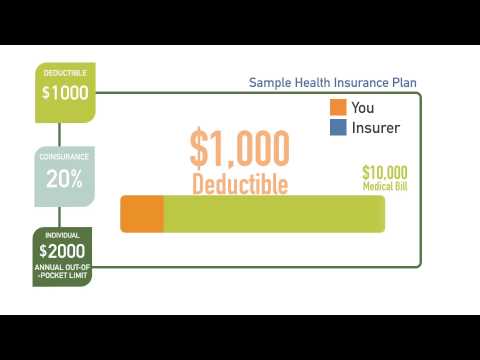

But just getting insurance policies safety isn’t sufficient. You furthermore may have to have to be familiar with the conditions of one's coverage. Looking through the high-quality print may not be fun, nonetheless it’s crucial to know what exactly’s included and what isn’t. You should definitely realize the deductibles, exclusions, and boundaries of your protection. By doing so, you can avoid awful surprises when you must file a claim. Expertise is electricity On the subject of insurance coverage.

The Facts About Insurance Solutions For Healthcare Providers Revealed

A further element to take into consideration could be the probable for bundling your insurance policies insurance policies. Numerous insurance policies firms offer you discount rates if you buy a number of varieties of insurance coverage by them, such as household and automobile coverage. Bundling could help you save income though making certain you have complete protection in place. So, in case you’re already searching for a single variety of insurance policy, it might be truly worth exploring your options for bundling.The notion of insurance plan security goes further than individual insurance policies too. Businesses have to have coverage far too. In Access now case you individual a company, you possible face risks which can effect your organization’s monetary overall health. Company insurance policy guards you from a range of troubles, together with residence problems, lawful liabilities, and employee-connected threats. By way of example, general liability insurance coverage can assist safeguard your business if a consumer is injured with your premises. Owning business insurance coverage gives you the safety to work your business with out constantly stressing about what could possibly go Incorrect.